Home Equity Loans vs. Equity Loans: Recognizing the Distinctions

Home Equity Loans vs. Equity Loans: Recognizing the Distinctions

Blog Article

Discovering the Advantages of an Equity Financing for Your Financial Objectives

Among the selection of economic tools offered, equity financings stand out for their prospective advantages in aiding people to reach their monetary objectives. The benefits that equity lendings provide, varying from versatility in fund usage to potential tax advantages, offer a compelling case for consideration.

Flexibility in Fund Usage

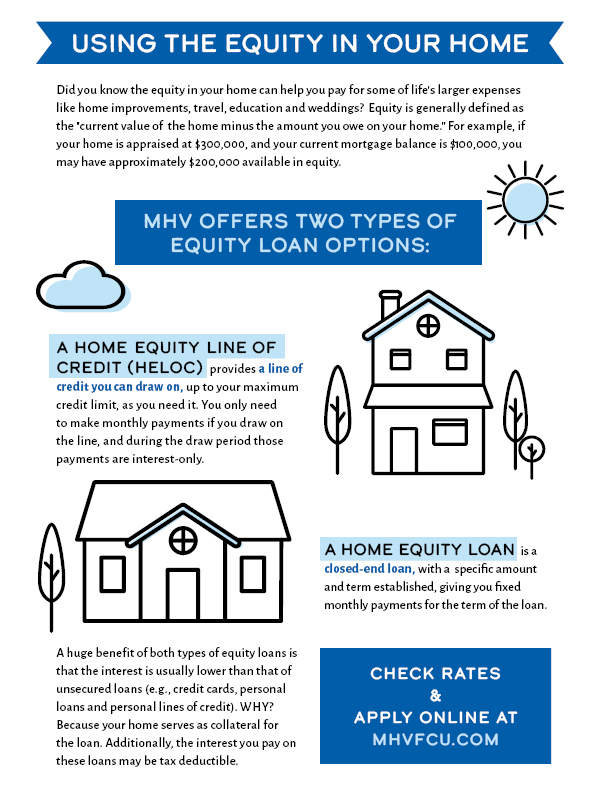

Adaptability in utilizing funds is a crucial benefit connected with equity car loans, giving consumers with versatile choices for managing their financial resources properly. Equity lendings allow people to access a line of credit scores based upon the equity they have actually accumulated in their homes. This flexibility indicates that consumers can utilize the funds for a range of functions, such as home renovations, financial debt loan consolidation, education and learning expenses, or also investment chances. Unlike some various other forms of financing, equity loans do not come with constraints on exactly how the funds can be used, offering customers the liberty to designate the cash where it is most needed.

Furthermore, the flexibility in fund usage reaches the amount borrowed, as customers can usually access a large sum of cash depending upon the equity they have in their property. This can be specifically helpful for people aiming to money substantial costs or jobs without resorting to high-interest choices. By leveraging the equity in their homes, debtors can access the funds they require while gaining from potentially reduced rates of interest contrasted to other kinds of borrowing.

Possibly Reduced Rates Of Interest

When thinking about equity car loans, one may find that they supply the potential for reduced rates of interest compared to different loaning alternatives, making them an appealing economic choice for numerous people. This advantage originates from the truth that equity financings are protected by the customer's home equity, which lowers the danger for loan providers. Due to this reduced level of threat, loan providers are usually happy to provide reduced rate of interest on equity car loans than on unprotected finances, such as individual lendings or charge card.

Reduced rates of interest can cause significant price financial savings over the life of the finance. By protecting a lower interest rate with an equity loan, customers can possibly reduce their total interest expenses and lower their regular monthly repayments. This can maximize funds for other financial goals or expenditures, inevitably boosting the debtor's economic setting over time.

Access to Larger Car Loan Amounts

Offered the capacity for reduced rates of interest with equity financings because of their secured nature, debtors may likewise benefit from accessibility to bigger finance quantities based upon their readily available home equity. This accessibility to bigger finance quantities can be helpful for people wanting to money considerable monetary goals or tasks (Equity Loans). Whether it's for home renovations, financial obligation combination, education and learning expenses, or various other considerable financial investments, the ability to obtain even more money via an equity loan offers customers with the financial flexibility needed to accomplish their purposes

Possible Tax Obligation Advantages

Safeguarding an equity go to this site finance might provide possible tax obligation benefits for customers seeking to maximize their monetary advantages. In numerous situations, the passion on an equity financing can be tax-deductible, similar to home mortgage interest, under certain conditions.

Additionally, using an equity lending for home improvements might additionally have tax obligation advantages. By using the funds to remodel or boost a primary or secondary residence, house owners might increase the residential or commercial property's value. This can be helpful when it comes time to market the home, potentially minimizing resources gains tax obligations or also qualifying for particular exclusion thresholds.

It is essential for customers to talk to a tax professional to completely understand the details tax obligation ramifications and advantages related to equity financings in their individual circumstances. Alpine Credits Home Equity Loans.

Faster Approval Process

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Final Thought

In recap, an equity car loan provides adaptability in fund use, possibly lower passion prices, accessibility to larger loan quantities, potential tax advantages, and a quicker approval procedure. These advantages make equity financings a sensible option for people seeking to achieve their economic goals (Alpine Credits Home Equity Loans). It is crucial to very carefully think about the conditions of an equity lending prior to choosing to ensure it straightens with your particular financial demands and objectives

Provided the potential for lower passion rates with equity lendings due to their protected nature, customers may likewise benefit from accessibility to bigger funding quantities based on their available home equity (Equity Loan). In comparison, equity financings, leveraging the equity in your home, can provide a quicker approval procedure because the equity serves as collateral, lowering the threat for lending institutions. By choosing an equity finance, consumers can accelerate the loan authorization process and accessibility the funds they need without delay, offering a valuable monetary option throughout times of seriousness

Report this page